Where Financial Services businesses should focus their digital transformation efforts in 2023

Like every business sector, Financial Services has been on a rollercoaster ride over the past couple of years. The pandemic forced a change in the way businesses work, and the way products and services are delivered to customers. Deloitte summed it up beautifully in the introduction to its ‘Finance 2025 Revisited report’1: “COVID-19 has sped up business innovation and stress-tested the concept of 100% remote work.”

Digital solutions became key to maintaining current customers and attracting new ones, with McKinsey’s ‘2022 Global Digital Sentiment Survey’2 finding that 125 million new consumers in the United States and Europe adopted digital channels over the same period. Interestingly, the five sectors leading the way in the survey were banking, telco, insurance, entertainment, and utilities, where digital adopters made up 90 percent of customers.

But what about now? Around the world, interest rates are rising, economic outputs are falling, and businesses are facing new risks and disruptions. In its ‘Industry Outlook 2023 report’3, the Economist Intelligence Unit looked at the challenges, opportunities, and trends to look out for across seven business sectors. For Financial Services, it reported:

Global financial firms will face tougher conditions in 2023 in an environment marked by slowing economic growth, spiking prices, unevenly rising interest rates and sharpening international political tensions … In the longer term, the industry will benefit from enduring trends towards greater use of digital services.

Note the slight uplift in optimism at the end of the quote. That’s something which also came out in McKinsey’s survey where a significant continuing demand was seen for new features in digital banking. It found that fintech businesses are driving digital expectations as well as competition, with around 60 percent of US and European consumers stating they would increase their use of digital banking if offered new features. A similar percentage would consider digital solutions for all of their banking needs.

It’s clear that the innovation in digital services spurred by the pandemic has been welcomed by customers, but how can the Financial Services sector stay in the driving seat in what is forecast to be a tough business climate in 2023? There are three areas to focus on:

- Release faster – but do so smarter

- Make protecting data part of the process

- Do more with less

Release faster – but do so smarter

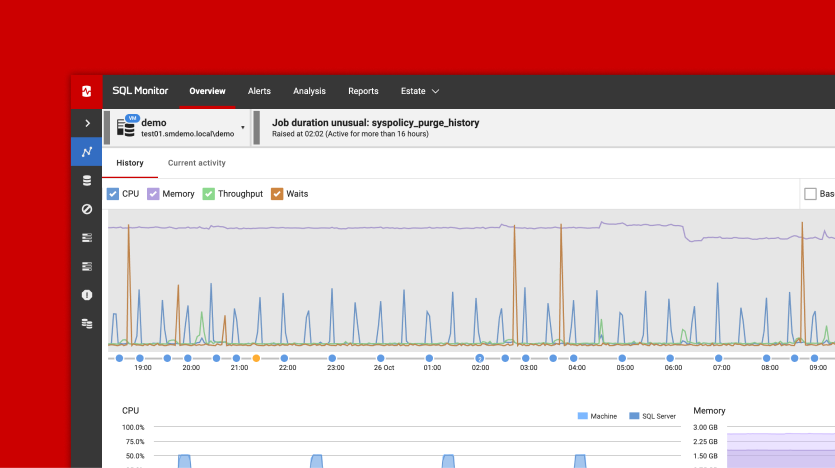

One common technology focus that emerges in businesses that outperform their competitors is their adoption of DevOps. No digital transformation would be complete without it because it encourages collaboration, uses automation to reduce laborious manual processes, streamlines workflows, and introduces tooling to increase efficiencies.

It’s consistently been shown to speed up releases, minimize errors in those releases, and deliver value to customers sooner. So much so that Redgate’s own State of Database DevOps survey showed that DevOps adoption increased from 47 percent across all sectors in 2017 to 74% in 2021, with no sign of the upwards trend slowing down. In Financial Services, levels of adoption were even higher at 81%.

There’s good reason for that, as seen in the long-running ‘Accelerate State of DevOps Report’4 which, over eight years, has developed and validated four metrics that measure software delivery performance. When comparing the outputs of high performing organizations which have adopted DevOps with low performers which lag behind, striking differences emerge in the 2022 report:

For high performers, what really counts here is having a lead time for changes of just one week – and being able to deploy those changes on-demand. Compare that with a lead time for changes of up to six months and being able to deploy, at best, once per month, and there is a clear competitive differentiator.

But it’s not just speed that matters – speed is nothing without some safety measures in place as well. That’s where the ‘do so smarter’ comes in. The change failure rate of high performers is also far lower, because the quality of releases is better. And even when there is an issue, the time it takes to restore changes is less than a day, compared with up to one month.

Key takeaway

We saw earlier that 60% of customers are willing to use new digital features. High performing organizations are in the best place to deliver those features and tap into the latent market demand. Now is the time to look at your own software delivery process to see where areas like version control, continuous integration and continuous delivery can be introduced, or automated, or improved upon to gain the advantages of higher performance.

Make protecting data part of the process

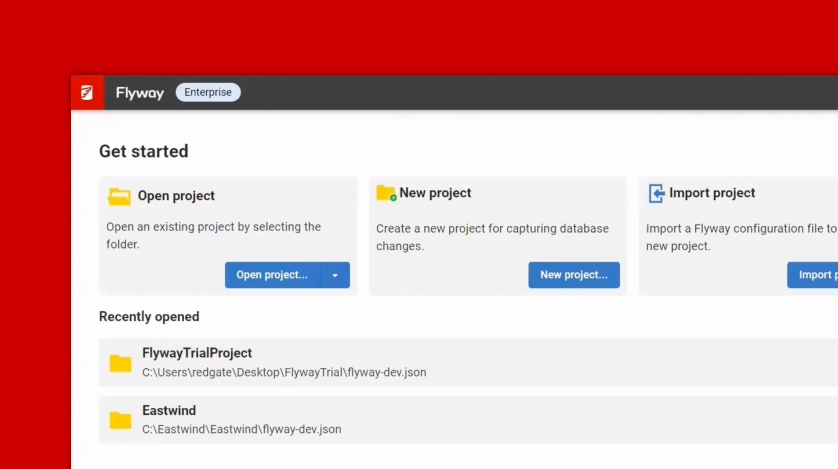

Just as application code needs to be updated to enable new features and services, so the code for the databases that support applications also needs to be updated. If databases are not developed in parallel and alongside applications, they become a bottleneck at the point of release.

This has long been recognized and the use of version control, continuous integration and continuous delivery for database code is well established. When the tools and practices are integrated with those used in application development, bottlenecks disappear and releasing database changes also becomes repeatable and reliable, with far few errors.

One issue that does come up in sectors like Financial Services is protecting the sensitive data inside those databases. Developers like to have a copy of the production database to test their changes against so that errors are caught early on and can be corrected immediately.

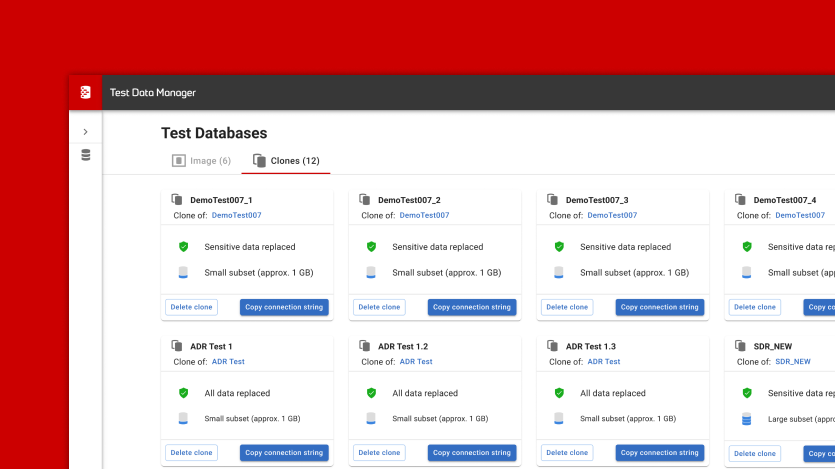

This has also been acknowledged for a long time and there are tools available that can both provision copies of production database quickly and efficiently, using virtualization to reduce their size significantly, and mask the sensitive date inside those databases. For example, Santam, South Africa’s leading general insurer, uses Redgate SQL Provision to deliver sanitized production data to its 13 development teams in seconds, saving 95% of storage space, while masking data to remain compliant with information security requirements.

There’s an added bonus to including the database in DevOps because the practices and processes that are introduced also help to protect data, by default and by design. They provide an audit trail of who changed what, when, and why; they enable IT teams to demonstrate they are looking after Personally Identifiable Information (PII); and most importantly they provide a way to reassure customers their data is being cared for, not just stored.

This is particularly relevant right now with sources like the Statista report, ‘Cyber Crime and the Financial Industry in the United States’5, showing cyber incidents in the sector worldwide have risen by 295% since 2013; the sector has the highest number of data breaches with confirmed data loss across the globe; and the average cost of a data breach is now $5.97m.

More worrying, however, are the leading factors that are now influencing consumers’ choice of a financial institution. The top five revealed in the Statista report are:

Of all the research conducted for this piece, this was the standout finding, with 100% of respondents placing the security of their personal information as their most important concern. The same picture is also seen among European consumers, with McKinsey’s ‘2022 Global Digital Sentiment Survey’ showing that consumer trust in digital channels has declined by six percentage points since 2021, and concerns about how data is handled, along with cyberattacks, top the list of trust issues.

This indicates that the demand for data privacy is moving from the decision making of the regulators to the buying choices of consumers. Quite simply, if the protection of their personal data is seen to be lacking, they’ll choose another provider. Reputation has become more important than regulation.

Key takeaway

While Financial Services customers are leading adopters of digital services, they have also become far more savvy and concerned about the security of their data. Fortunately, including the database in DevOps provides audit trails than can demonstrate the care taken to protect data. When data is sanitized by methods like masking, it also protects data, even if a breach occurs. All of which suggests you should explore how your database development practices can help with compliance, and how data can be sanitized to protect it from breaches without slowing down development.

Do more with less

Every business in every sector is now facing the same challenge: to extract the maximum value from any IT investment. For those in Financial Services, S&P Global Market Intelligence offers some advice on how to do so in its Big Picture report, ‘2023 Financial Institutions Industry Outlook’6. In the section ‘Rewriting the fintech playbook’, it reveals that fintechs are right-sizing their operations to meet lower growth expectations. However, it also predicts that:

In the short term, we expect fintechs will avoid cutting tech spending too much. Despite being a short-term expense, some tech investments can lower costs in the long run by automating processes and improving models. Companies likely also view tech spending as fundamental.

Among banking institutions, the outlook is similar, as outlined in the Forrester report, ‘Predictions 2023: Banking’7. Although cutting costs is a priority for the majority, Forrester states many will shift over half of their IT spending to projects that increase operational efficiency with measures like automation. This will help them move from legacy systems and reduce what Forrester refers to as technical debit which can hinder them losing out to more agile competitors.

Forrester sees the same among insurance companies with the need to reduce costs one of the top business priorities in 2023, alongside decreasing the burden of technical debt, with IT investment focusing on areas like intelligent automation.

What’s fascinating here is that across all businesses in Financial Services, the pressures are the same, and so are the outcomes: reducing costs by increasing efficiencies, automating processes where possible, and reducing technical debt. As Forrester states in the introduction to its report:

They will look to batten down the hatches while the storm passes. But the smart firms will ensure that the investments they do make will put them in a strong position for the subsequent economic upturn.

We’ve already seen that DevOps has a part to play here. DevOps encourages the streamlining of workflows, and the automation of labor-intensive tasks that are manual and error-prone. This doesn’t just increase efficiency, it also makes processes reliable, robust, and repeatable, which increases the quality of the code being developed.

By default, because DevOps prompts collaboration with developers following similar processes, it standardizes the tools and tech stacks used both within and across teams. This in turn makes it easier for teams to adjust when developers join, leave, or change teams, and reduces that technical debt which appears to be so prevalent in the sector.

Key takeaway

Like other sectors, those in Financial Services will need to tighten their belts during 2023. While there is a need to cut costs, there are also clear signals for businesses in fintech, banking and insurance to take the opportunity to once again use IT to help meet the challenges ahead. By focusing on standardization and introducing automation, IT teams can reduce costs and increase efficiencies, while also ensuring their businesses are more competitive.

For more information about how Redgate can help you speed up your digital transformation initiatives while helping you reduce costs and increase efficiencies, visit our solution pages.

Reference sources:

- Deloitte, Finance 2025 Revisited: https://www2.deloitte.com/us/en/pages/finance-transformation/articles/future-finance-trends-2025.html

- McKinsey, 2022 Global Digital Sentiment Survey: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/digital-resilience-consumer-survey-finds-ample-scope-for-growth

- Economist Intelligence Unit, Industry Outlook 2023: https://www.eiu.com/n/campaigns/industries-in-2023/

- 2022 Accelerate State of DevOps Report: https://cloud.google.com/devops/state-of-devops/

- Statista, Cyber Crime and the Financial Industry in the United States: https://www.statista.com/topics/9918/cyber-crime-and-the-financial-industry-in-the-united-states/

- S&P Global Market Intelligence: https://pages.marketintelligence.spglobal.com/Big-Picture-Reports-2022-EYP-FI-Corps-cd-Request.html

- Forrester, Predictions 2023: Banking: https://www.forrester.com/report/predictions-2023-banking/RES178178

THOUGHT LEADERSHIP

Article hub

Read more from Redgate leaders - on digital transformation, the role of the database and more.